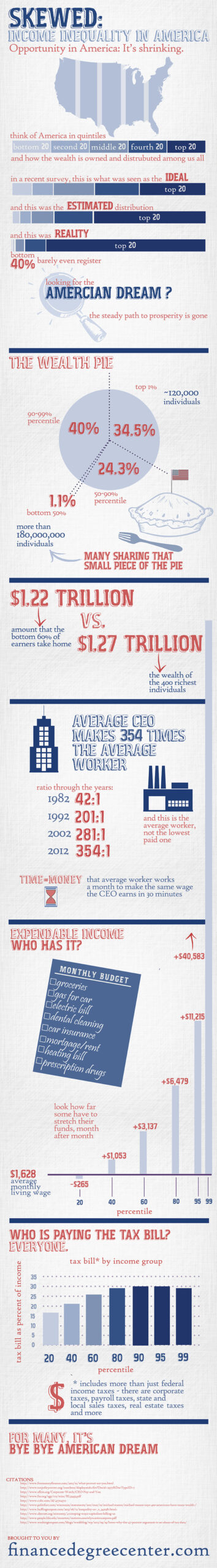

Opportunity in America: It’s shrinking

Except for the few

[% wealth held by percentile][4]

0-50th: 1.1

50-90th: 24.3

90-99th:40

99-100th:34.5

Lowest 60% of earners are making < the wealthiest 400 Americans: $1.22 trillion vs. $1.27 trillion [6] To put that in context: The average wealth of one of the 400 richest Americans is equal to the average wealth of 510,000 people in the bottom 60%

With the 1%’s wealth much more tied to the real estate, stock market

Note: The SNAP (food stamp) budget of $78 billion is less than the investing budget of 20 wealthy Americans[8]

CEO vs. Worker inequality

The Average CEO makes 354 times what the average worker makes[3]

[year: ratio between worker/CEO earnings]

1982: 42:1

1992: 201:1

2002: 281:1

2012: 354:1

Differences in expendable income are staggering

The average nationwide 1 adult living wage is $19546.17. Here’s how that breaks down per quintile:

Per month:

20%– -$3188

40%– +$12641

60%– +$37655

80%– +$77751

90%– +$134,584

99%– +$487,006

Or:

20%– -$61.3

40%– +$243.09

60%– +$724.13

80%– +$1495.21

90%– +$2588.15

99%– +$9365.5

Per week.

With Strong Racial Correlates

The Average White household in 2007 had a net worth of $143,600

14 TIMES the average net worth of Hispanic or black households[7]

Myth: rich Americans don’t pay their taxes

But at least the super-rich pay their taxes.

With the top 400 earners paying $16 billion in taxes.[5]

But that doesn’t help the 21.4% of children who grow up in poverty. [7]

Without greater income equality, democratic ideals are a sham.

Citations:

- http://www.freemoneyfinance.com/2012/01/what-percent-are-you.html

- http://www.taxpolicycenter.org/numbers/displayatab.cfm?Docid=2977&DocTypeID=7

- http://www.aflcio.org/Corporate-Watch/CEO-Pay-and-You

- http://www.fas.org/sgp/crs/misc/RL33433.pdf

- http://www.cnbc.com/id/47704712

- http://www.politifact.com/wisconsin/statements/2011/mar/10/michael-moore/michael-moore-says-400-americans-have-more-wealth-/

- http://www.huffingtonpost.com/2013/06/12/inequality-us-_n_3421381.html

- http://www.alternet.org/economy/4-creeping-ways-capitalism-killing-us